are campaign contributions tax deductible in 2020

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Whats changing from tax year 2019 to tax year 2020.

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

While tax deductible CFC deductions are not pre-tax.

. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. Limits for regular and special elections recounts how to designate contributions. Changed in the 2020 tax year that allowed taxpayers to deduct as much as 300 for each tax of qualified cash contribution.

The answer is no political contributions are not tax deductible. Contributions or donations that benefit a political candidate party or cause are not tax deductible. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Includes limits that apply to individual donations as well as to contributions by political action committees PACs and party committees to candidates. Learn how campaign contributions can be used when an election is over.

Can a deduction to a political campaign be deducted on the donors federal income tax return. The 2019-2020 contribution limit was capped at 2800. Resources for social welfare organizations.

According to the IRS the answer is a very clear NO. The following chart shows more details on the FEC campaign contribution limits for. That includes donations to.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year. In 2009 about two-thirds of candidates surveyed said that the states tax credit program brought in new donors.

WRONG for 2020. Payments made to the following political causes are also not tax deductible. Resources for business leagues.

The amount an individual can contribute to a candidate for each election was increased to 2800 per election up from 2700. The answer is no. According to OPM you can deduct even if you take the standard deduction and do not itemize.

All four states have rules and limitations around the tax break. When a campaign solicits contributions through public communications or on a campaign website it must include a clear and conspicuous notice on the solicitation stating that it was authorized and paid for by the campaign. The CARES Act enacted by Congress in spring 2020 includes a special 300 deduction designed especially for people who choose to take the standard deduction rather than itemizing.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. For people that want to donate money to a political campaign it is essential to think if one can deduct it from your tax return. Important tax changes in 2020.

The answer is no political contributions are not tax deductible. Since each primary and the general election count as separate elections individuals may give 5600 per candidate per cycle. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases.

A charitable contribution under the Internal Revenue Code means a contribution or gift to. Your donation through December 31 2020 to 501 c 3 nonprofit organizations will qualify for this incentive and can be claimed on. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. Resources for political.

The same goes for campaign contributions. Paid for by the Sam Jones for Congress Committee For details visit Advertising. This amount doubled for the 2021 tax year for married people filing jointly and 300 for.

Cost of admission to a political event including. You can obtain these publications free of charge by calling 800-829-3676. Resources for charities churches and educational organizations.

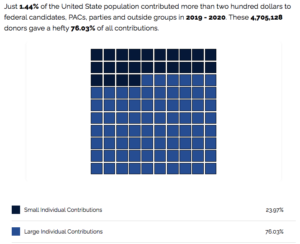

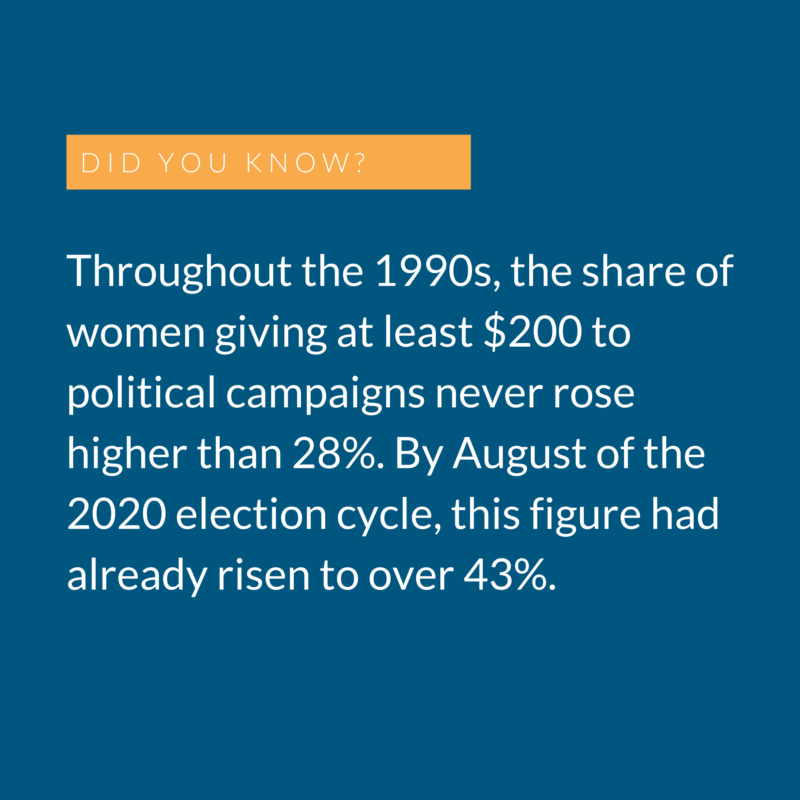

OPM sent out a message that states. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529. When people do give most political donations are large given by a few relatively wealthy people.

After years of public service federal retirees may want to continue giving. Resources for labor and agricultural organizations. Advertisements in a political convention program or politically affiliated publication.

The Federal Election Campaign Act limits contributions to 2900 per election for the 2021. In Minnesota a registered voter can claim a Political Contribution Refund equal to her donation to a state-level candidate or Minnesota political party up to 50. The Combined Federal Campaign CFC is one of the largest and most successful workplace fundraising campaigns in the world.

Joint filers can claim up to 100. Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either.

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

Political Campaign Restrictions For Charities Jonathan Grissom Nonprofit Attorney

Are Political Contributions Tax Deductible

Campaign Finance The Policy Circle

Campaign Materials United Way Of The Greater Chippewa Valley

Campaign Finance The Policy Circle

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible H R Block

Fbi Probe Spurs Questioning Of Money In Anaheim Politics Campaign Finance Reform

Federal And California Political Donation Limitations Seiler Llp

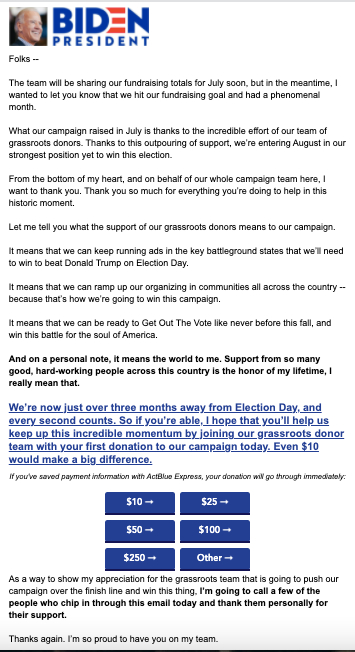

The Secret To Writing Political Donation Letters With Samples

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Campaign Contributions Tax Deductible

Are Political Donations Tax Deductible Credit Karma Tax

Meet The Minnesota Political Groups Spending Big On The 2020 Election Minnpost

Are Political Donations Tax Deductible